Going freelance can mean taking control of your career—choosing your clients, managing your own time, and eventually reaping the benefits of your self-made success. Before your get started on your self-employment, you need to register with the Bureau of Internal Revenue so you can file your income tax. We’ll walk you through the steps and list down the requirements to help you out.

If you’ve previously been employed (or still are), your company usually takes care of your income tax return. But if you’re transitioning to becoming a self-employed individual either as a sole proprietor of a business or practicing a profession, you’ll either have to file your own taxes or enlist the services of an accountant or third-party provider to accomplish this. Either way, it’s best to know the basics, so you’re not going into this blindly.

Getting started

If you don’t have one yet, you’ll need to apply for a Tax Identification Number. For self-employed and mixed income individuals, these are the things you’ll need:

- An accomplished BIR Form 1901 (downloadable from the BIR website)

- An accomplished BIR Form 1905 if you are updating your registration information (downloadable from the BIR website)

- An accomplished BIR Form 1906 for printing receipts and invoices (downloadable from the BIR website)

- Any government-issued ID that has your name, address, and birth date (birth certificate, passport, driver’s license, community tax certificate)

- Photocopy of Mayor’s business permit (or application if it is still being processed); and/or professional tax receipt or occupational tax receipt issued by your local government unit; or DTI certificate

- Proof of payment of annual registration fee (PHP500) using BIR Form 0605 (downloadable from the BIR website)

- Final and clear copy of sample receipts and invoices

Once you have all of the documents, head to your Revenue District Office (RDO) and head to the New Business Registrant counter. After submitting the documentary requirements, your RDO should give you BIR Form 2303 which is the Certificate of Registration that has the “Ask for Receipt” notice. This is what makes you a legitimate business along with your Official Receipt (OR), which you’ll need to issue to clients when receiving compensation for any service.

We highly recommend that you attend the briefing for new business registrants at your RDO (it’s absolutely free!), so you can ask any questions you might still have after registering. If you are unable to, an officer in charge is also present at your RDO to assist you on any business day.

What happens next

Once you’ve got your COR and OR, you’ll also need to learn how to manage your books. You’ll be given a Journal and a Ledger. Here’s how you can organize them.

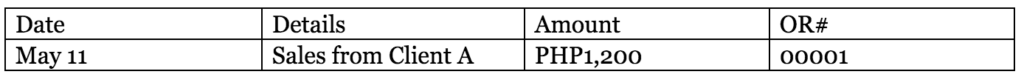

For daily transactions, log them on your Journal. Remember that any compensation above PHP25 should have an OR. Here’s a simple template you can follow.

Your Journal can also include expenses (such as utilities) that you incur in the course of your business services. This will be quite helpful when you’re doing your quarterly income tax return or annual income tax return.

For your Ledger, you can use it to record your Monthly or Quarterly sales. It’s basically a summary of your daily Journal for the entire tax year.

Important dates to remember

Now that you’re a registered self-employed individual, you must remember to file your income tax. Here are the important dates to remember:

April 15 – annual income tax for the previous tax year

May 15 – first quarter income tax

August 15 – second quarter income tax

November 15 – third quarter income tax

You’ll also need to pay the annual registration fee (PHP500) every year. Make sure to accomplish this before January 31 at the beginning of the tax year.

Things to note

When issuing an OR to a client, make sure to have the client’s Registered Trade Name, TIN, and Business Address. If they are paying you in check, note the issuing bank, check number, and date the check was issued. If they are withholding tax from your fee, don’t forget to ask for BIR Form 2316 or Certificate of Tax Withheld for Compensation. You’ll need this when it comes to filing your income tax.

Why register at all

You might be asking, why go through all this trouble in registering your business? One of the advantages of being registered with the BIR is your annual income tax return, which is proof of your earnings. This can prove useful for transactions that will require proof of income such as travel visas, credit cards, and bank loans. Another advantage of having official receipts is that more companies or clients will be inclined to get your services since you are a legitimate business entity. And in the end, isn’t that always a good thing?

Launchpad can help

If you’re still not sure how to go about the registration process, here at Launchpad Coworking, we are committed to helping you with your business needs. Just approach our community manager to inquire about rates and what you’ll need to provide to avail of the service.